Data-Driven Business Models

Although we are awash with data, making money from it is not always straightforward. Low barriers to entry and the commoditization of many data sources mean that creating and then sustaining a profitable data-driven business model is a considerable challenge. My current research into the business models of over 500 startups and high-growth, venture-backed companies which have data at the core of their operations is revealing a wide range of approaches and strategies. This article looks at 4 of these companies and considers their potential for growth, profitability and competitive positioning. I hope it will be useful for anyone starting or thinking of starting a data-driven business.

Tussell (£1 million funding raised since January 2018) – https://www.tussell.com/

Tussell is an aggregator of open source data on UK public sector contracts. While much of this information is freely available via the data.gov.uk website, Tussell pulls this data together and makes it easier for customers to extract meaning from it in terms of opportunities for bidding for public contracts and details of competitors already managing contracts in a market they claim was worth £223 billion in 2017. They also offer bespoke analysis for clients via their team of analysts.

Value Proposition:

- reducing friction and saving time for businesses that want to expand their income from public sector clients;

- adding value to raw data and turning it into more actionable intelligence.

Strengths of Business Model:

- core input is free;

- value-added analysis and aggregation creates new data layer that provides partial barrier to competitive threats;

Risks to Business Model:

- reliance on open source data reduces barriers for competitors;

- risk of new government policy on access to open source data undermining Tussell’s key input.

OpenSignal (£8.8 million funding raised since September 2012) – https://opensignal.com/

OpenSignal provides a mobile app for smartphone users around the world to check the quality of network coverage wherever they are, allowing them to compare network operators for coverage. The company then aggregates this data which their app has collected and sells it on to network operators and regulators. By crowdsourcing their data they have managed to create a unique database which has value to businesses and consumers. This plays to the strengths of B2B and B2C information-based products; consumers are generally unwilling to pay for information while businesses will do so if there is a commercial value to it. This is a similar model to Google’s and Facebook’s in that the process of using the free service by individuals generates marketing opportunities for advertisers and, particularly in Google’s case, helps the company understand user behaviour on the web via search result clickthroughs.

Value Proposition:

- helps consumers choose the best network operator for where they live/work;

- helps network operators better understand their competitors and spot opportunities for increasing revenues via network investments in underserved areas.

Strengths of Business Model:

- creation of unique, proprietary dataset raises barrier to entry for competitors;

- global coverage reduces reliance on single countries;

- crowd sourced data reduces sourcing costs.

Risks to Business Model:

- pooling of operators’ own data to create rival dataset;

- launch of competitor app which offers rewards to users for sharing their data.

MyLocalPitch (£1.3 million funding raised since December 2016) – https://www.mylocalpitch.com/

MyLocalPitch makes it easier for users in the UK and Ireland to locate and then book sports pitches and courts via an app or their website for a range of activities including football, tennis and squash. The service is free to consumers and the company generates revenue by taking commissions on bookings from venue owners and/or charging owners for value-added services such as payment outsourcing.

Value Proposition:

- reduces friction for consumers wanting to find and book sports venues across the UK;

- helps venue owners to increase their visibility, find new customers and streamline booking administration.

Strengths of Business Model:

- offering a platform for booking and payment increases lock-in of venue owners;

- single app for managing bookings across multiple venues increases lock-in of consumers.

Risks to Business Model:

- development of proprietary apps by large operators of multiple sporting venues;

Emolument (£1 million funding raised since June 2013) – https://www.emolument.com/

Emolument provides an online service for users to check their salaries against benchmarks for their sector. Similar to OpenSignal, they offer the service free to users who upload their own salary data and then sell this aggregated data to employers wanting to better understand what salaries their competitors are paying.

Value Proposition:

- allows users to check if they are being paid in accordance with their peers in other organisations;

- allows employers to benchmark the salaries they are paying against others in their sector.

Strengths of Business Model:

- creation of unique, proprietary dataset raises barrier to entry for competitors;

- crowd sourced data reduces sourcing costs.

Risks to Business Model:

- launch of similar product by LinkedIn – also makes Emolument a potential acquisition for LinkedIn;

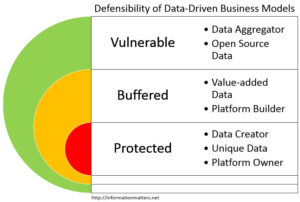

So what can we conclude from these examples? Perhaps the main lesson for data-driven startups is the importance of building a sustainable business model which provides a degree of protection against competitors. Companies like OpenSignal and Emolument have done a good job of creating an attractive value proposition to both the business and the consumer markets they serve while exploiting network effects to make it more difficult for new entrants to develop competitive offerings. Their businesses can be seen as flywheels which generate energy as their consumer base adds more data, resulting in added value for the business customers who pay for access.

Martin De Saulles

Editor, Information Matters

Dr Martin De Saulles is a writer, analyst and lecturer specializing in the commercial applications of data.