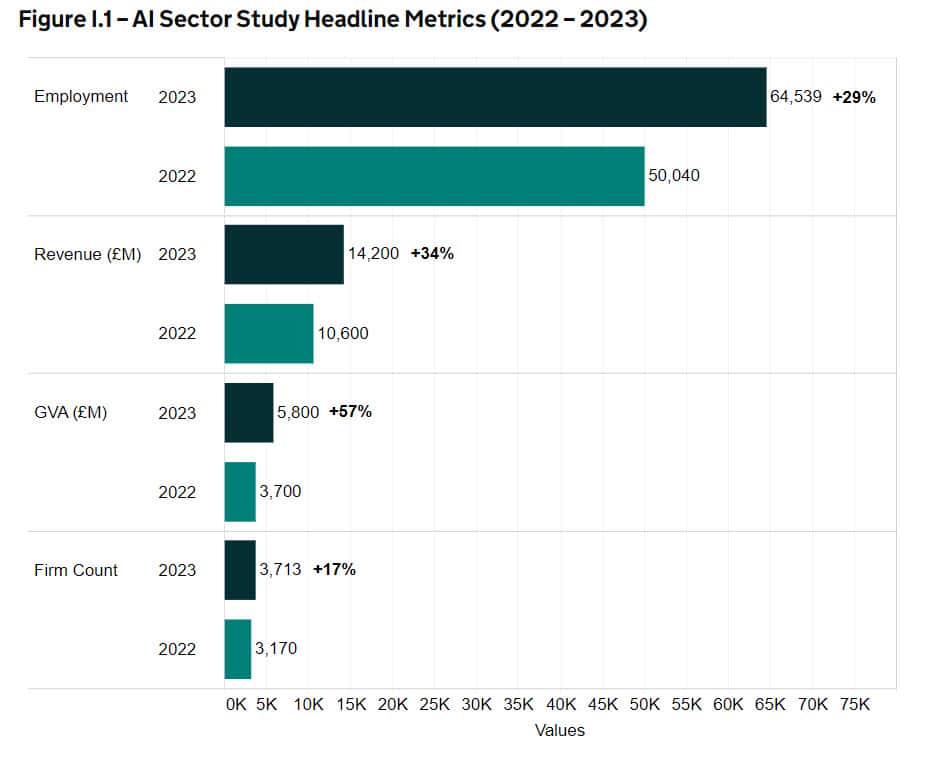

The United Kingdom’s artificial intelligence sector has demonstrated remarkable growth in 2023, with revenues reaching £14.2 billion and employment surging by 29%, even as the industry grapples with investment challenges and international competition, according to a comprehensive government study released this month.

The report, commissioned by the Department for Science, Innovation & Technology (DSIT), reveals that the UK’s AI sector now comprises 3,713 active companies, marking a 17% increase from the previous year. These firms collectively employ 64,539 full-time equivalents, up from 50,040 in 2022, highlighting the sector’s robust expansion despite global economic headwinds.

However, beneath these impressive headlines lies a complex picture of a market increasingly dominated by international players and facing significant scaling challenges for mid-sized companies. The study shows that while internationally headquartered firms represent just 9% of UK AI companies, they account for 47% of AI-related revenues and 33% of employment, underscoring the outsized role of foreign firms in the UK’s AI ecosystem.

Market concentration is becoming particularly notable, with the top 10 AI companies accounting for 62% of the sector’s total Gross Value Added (GVA). This concentration is even more pronounced among dedicated AI firms, where the top 10 companies generate 81% of GVA within their segment.

The geographical distribution of AI activity remains heavily skewed toward London and the southeast, with 75% of registered office locations concentrated in London, the South East, and the East of England. This regional imbalance extends to investment patterns, with London-based companies securing £822 million, or 72% of total equity investment in 2023.

Investment Landscape Shows Mixed Signals

The investment picture presents both challenges and opportunities. While the total value of investment in AI companies fell by 53% to £1.2 billion in 2023, the volume of deals remained relatively stable, suggesting better value for investors. The average deal size has returned to pre-pandemic levels at £2.3 million, down from £4.6 million in 2022.

Notably, the early months of 2024 have already seen £1.5 billion in equity investment through 150 fundraising deals, indicating a potential rebound in investor confidence. However, access to growth capital remains a critical challenge, particularly for companies seeking Series B funding and beyond.

“A £2 million round in the UK is probably the same sort of risk and time to completion as a $10 million round in the US,” noted one investor interviewed for the study. This funding gap at the growth stage is pushing promising UK startups to seek investment in the United States, potentially leading to a talent drain.

Talent and Infrastructure Challenges

The competition for AI talent has intensified, with 26% of surveyed companies citing a lack of technical skills as a significant barrier to growth. The median advertised salary for an AI Engineer in London stands at £87,500, 17% above the UK average and approximately double the overall median salary in the country.

Infrastructure costs and access to computing power have emerged as major challenges, particularly for smaller companies. Seventy percent of survey respondents indicated an increased need for computing power, while 68% highlighted growing requirements for software and development tools.

Regional Strengths and Specializations

Despite the London-centric nature of the industry, certain regions show distinctive strengths in specific AI applications. Areas outside London, the South East, and East of England demonstrate greater activity in automotive and transportation, manufacturing, energy and utilities, and agricultural technology applications.

The study reveals that Scotland, the South West, and the North West each account for between 4-5% of AI companies in 2023, with healthcare, strategy and consulting, and computer vision accounting for over half of new company incorporations outside London.

International Trade and Collaboration

The UK’s AI sector shows strong international engagement, with 65% of surveyed companies involved in exports, up 14 percentage points from 2022. Of these exporters, 60% generate at least 40% of their revenues from international trade, and 75% expect their exports to increase in the next 12-18 months.

The ecosystem demonstrates robust collaboration, particularly among leading dedicated AI companies. Twenty-seven of the largest dedicated AI firms have established partnerships with approximately 130 organizations, including prestigious universities, major corporations, and public sector bodies.

Looking Ahead

While the UK AI sector shows impressive growth in revenues and employment, the report highlights several challenges that could impact future development. These include the need for more equitable regional development, improved access to growth capital, and solutions to infrastructure and talent constraints.

The concentration of market power among a small number of large players, particularly international firms, presents both opportunities and risks for the UK’s AI ecosystem. While these companies bring valuable resources and expertise, their dominance could potentially limit competition and innovation from smaller, domestic firms.

Nevertheless, the vibrancy of the UK’s AI ecosystem, particularly in research and development where 238 dedicated AI companies account for 42% of total GVA generated by dedicated AI companies, suggests a strong foundation for future growth. The challenge for policymakers will be ensuring this growth benefits the entire UK economy while maintaining the country’s competitive position in the global AI landscape.