Our analysis suggests that between 25% and 30% of this traditional software revenue could be diverted from legacy SaaS subscriptions to consumption-based AI agents and “headless” workflows by 2030.

We are beginning a massive period of disruption in the enterprise application market. This is driven by the potential of agentic AI to upend long-established business processes, B2B procurement practices and supply chains. Accelerating this is the rise of open protocols allowing agents to talk to other agents as well as pull data in from multiple external data sources. Agent2Agent (A2A) and Model Context Protocol (MCP) are key drivers of change here. These both recently joined the Linux Foundation which will give confidence to developers building agentic AI solutions, making disruption even more likely.

Open protocols present a threat to a number of established enterprise applications which have profited from siloed data and legacy software lock-in preventing true data sharing across the enterprise and beyond. We can imagine a scenario where MCP becomes the universal connector allowing, for example, an AI model to read a sales opportunity from Salesforce (CRM), check inventory in SAP (ERP), and draft a contract in Workday (HCM) without the user needing to build three separate custom integrations.

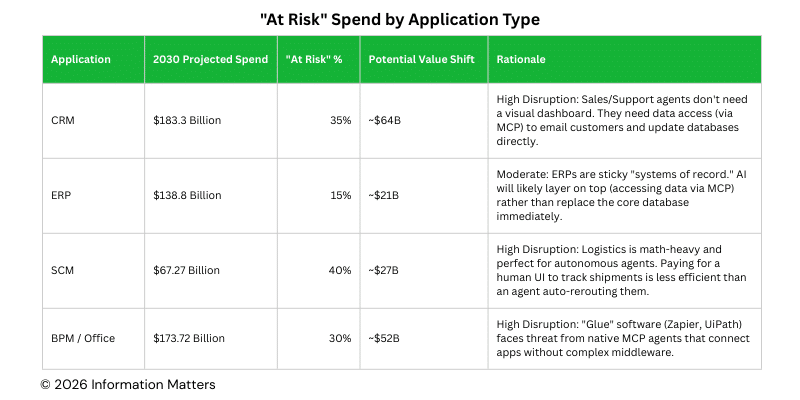

Based on the current market trajectory for Agentic AI and the Model Context Protocol (MCP), Information Matters estimates a significant portion of the projected $690 billion global enterprise software spend in 2030 is considered “at risk” of disruption.

Our analysis suggests that between 25% and 30% of this traditional software revenue could be diverted from legacy SaaS subscriptions to consumption-based AI agents and “headless” workflows by 2030.

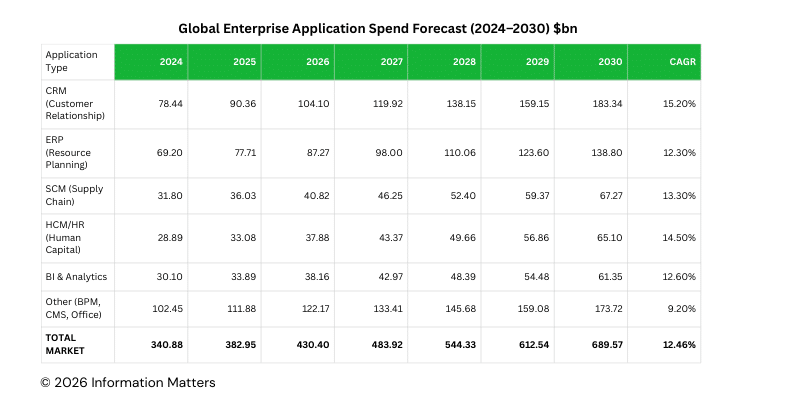

Table 1 presents our forecasts for global enterprise application spending to 2030. These are conservative estimates with a forecast total spend of $690 billion by 2030. However, the market shares of established enterprise application vendors could change significantly over the following 5 years. AI-native new entrants able to leverage enterprise data assets and augment them with third party sources while layering agentic capabilities on top could take over $160 billion of global enterprise spend by 2030. We are still modelling some of these scenarios and will be reporting soon on how this might happen, where the greatest value capture will occur and which new entrants stand a chance of disupting this sector that has changed little in several decades. Our initial research indicates some enterprise application types are at more risk than others, at least in the medium term. Table shows these impacts and the potential impact on incumbent vendor revenues. Overall, this presents a value shift of up to $164 billion.