Information Matters research estimates that agentic AI adoption over the coming 5 years will transform firm and market structures with up to $9 trillion in fully orchestrated revenue from agentic commerce globally by 2030.

Why do firms exist if the invisible hand of the market is so powerful? The economist Ronald Coase asked that in 1937 and published his conclusions in his seminal paper, The Nature of the Firm1. He concluded that transaction costs were at the core of this and these boiled down to 3 main types:

- Searching for providers and discovering what the relevant prices are.

- Negotiating and drafting separate contracts for every single exchange.

- Enforcing those contracts and monitoring for quality.

Coase argued that it was more efficient for firms to be created to handle these activities than relying on market forces to sort them out. The economies of scale and scope that businesses could achieve allowed greater profits to be generated. For larger enterprises this required inhouse teams of experts to handle legal, marketing, research and other core activities associated with producing and selling goods or services.

Until now this has been the norm in most markets. Some sectors such as retail and logistics lend themselves to greater competition and lower margins while others such as banking have been able to operate on higher profit margins and have gone to scale reducing competition from new entrants.

This is all about to change as AI and specifically agentic AI upends the 3 tenets Coase outlined to explain the rationale for firms to exist.

Reducing Friction

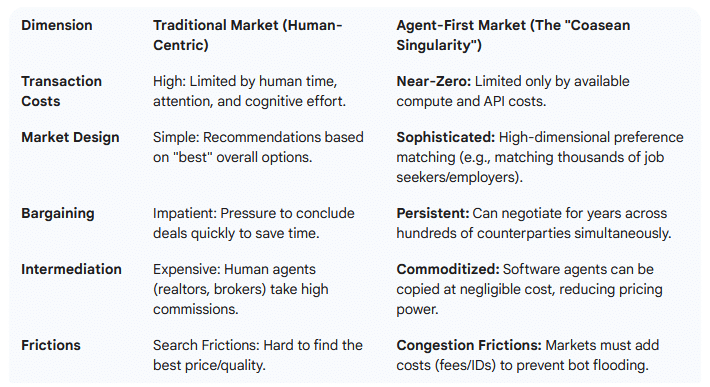

Taking out or reducing human inputs from commerce will speed up some activities powering supply chains and buying processes but will introduce other variables with uncertain outcomes. Shahidi and colleagues from Harvard University and MIT recently published a paper2 outlining what they see as some possible outcomes:

- Dramatic Reduction in Transaction Costs: AI agents can perform tasks like searching for products, negotiating prices, and monitoring contract compliance at a near-zero marginal cost. This shift challenges traditional “make-or-buy” boundaries that define firm organization.

- Expansion of Market Design: Agents make complex market mechanisms—such as the deferred acceptance algorithm—feasible at scale because they can efficiently elicit and rank thousands of user preferences that are too cognitively demanding for humans to manage.

- Shift in Bargaining Power: Unlike humans, AI agents are constrained by “compute” rather than “time”. They can engage in hundreds of parallel, long-term negotiations, effectively giving every user the negotiating power of a frequent, high-volume transactor.

- New Market Frictions: By making transactions nearly costless, agents may cause “congestion” (e.g., flooding employers with thousands of AI-generated job applications). This will force markets to introduce new frictions, such as small fees for applying to jobs or “pay-per-crawl” models for websites.

As the authors state, agentic AI has the potential to change the economics of many long-established business practices.

“The activities that comprise transaction costs—learning prices, negotiating terms, writing contracts, and monitoring compliance—are precisely the types of tasks that AI agents can potentially perform at very low marginal cost.”

However, such impacts are still some way off. We are seeing the early stages of these changes across a wide range of sectors. Academic researchers are making use of ChatGPT’s and Gemini’s deep research tools that perform iteratively from initial user prompts. These tools break down prompts into stages and perform data gathering and analysis sequentially without further user input. Salesforce’s AgentForce, Mirakl’s Marketplace-as-a-Service offering and platforms from companies like Procuros and Traba point the way to where this may be heading in B2B markets.

Canaries in the coalmine

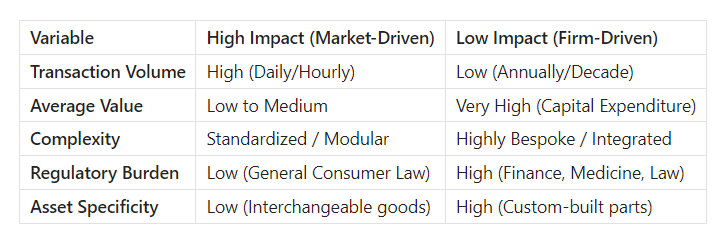

These changes will impact sectors in different ways and at different times. Sectors with high transaction volumes and low-to-medium complexity will see the most immediate “Coasean” shift.

– Retail & Consumer Goods (B2C): AI agents act as “personal shoppers” that continuously scan for the best price, fit, and delivery time. This diminishes the power of traditional brand marketing, as AI prioritizes objective data over emotional advertising.

– Wholesale & Logistics (B2B): Procurement is often the first department to automate. AI agents can manage thousands of micro-contracts for raw materials or shipping slots, reducing the need for large internal purchasing departments.

– SaaS and Digital Services: “Agentic Commerce” allows software to buy other software services (e.g., an AI developer agent buying cloud credits or API access) in real-time.

Other sectors will be more resistant to dramatic changes. In these industries, transaction costs aren’t just about “search” or “negotiation”—they are about trust, liability, and legal oversight, which AI cannot yet fully absorb.

– Healthcare & Life Sciences: Transactions involve sensitive patient data and strict regulatory compliance (HIPAA, etc.). Human oversight remains a legal requirement, keeping transaction costs high and favoring large, integrated institutions.

– Heavy Industrial / Infrastructure: Deals for power plants or aerospace components involve “asset specificity”—highly custom products that can’t be easily swapped. These require long-term human relationships and multi-year contracts that AI agents cannot easily commoditize.

The Hollow Firm

As agentic AI lowers market transaction costs, we may see a shift in the “Nature of the Firm”:

– Shrinking Mid-Sized Firms: Small, agile teams using AI agents can now coordinate complex global supply chains that previously required a mid-sized company’s infrastructure.

– The Rise of the “Micro-Multilateral”: We may see a surge in “firms” that are essentially a single human director managing a fleet of AI agents that interact with other AI agents in a frictionless global market.

– Strategic Consolidation: Conversely, large firms may become “platforms” that own the AI agents themselves, essentially internalizing the market’s data to maintain their competitive advantage.

So what might this mean for employees? In B2B, the Procurement Clerk and Inventory Manager roles are at high risk (90%+ automation potential), while Category Managers who handle high-stakes strategic relationships will remain essential to manage the “exceptions” that AI cannot. Doubtless, new roles will emerge as we’ve seen in previous technological revolutions. Tabulators and many admin roles were replaced by computers from the 1960s onwards but more highly skilled and creative tasks emerged to be filled by humans.

Looking Ahead

We firmly believe agentic AI will transform business and markets as we know them today. These changes may take longer than many optimistic vendors might have you believe but the technology is already making inroads into multiple areas of commerce. The core distinction is that while Generative AI advises, Agentic AI executes.

Here are some of our thoughts on the impact on B2C and B2B sectors over the coming 3 to 5 years.

– B2C Retail: The Rise of “Agentic Commerce” In B2C, the most significant shift is the collapse of the marketing funnel. Retailers are moving from a world of “Search Engine Optimization” (SEO) to “Answer Engine Optimization” (AEO) and “Agent Readiness.”

– The “Invisible” Customer: By 2027, it is predicted that a significant portion of B2C transactions will be initiated by Personal Shopping Agents rather than humans. These agents will autonomously compare prices, check ingredient transparency, and negotiate “first-time buyer” discounts without the human ever seeing an ad or visiting a homepage.

– Erosion of Brand Loyalty: Evidence suggests that agents prioritize logic and utility over emotional branding. If an agent finds a product with better reviews, a lower carbon footprint, and a $2 price difference, it will switch brands instantly.

– Hyper-Personalized “Brand Agents”: To counter third-party agents, retailers (like Walmart and luxury brands) are deploying their own Brand Agents. These act as 24/7 concierge services that don’t just answer questions but manage the entire lifecycle—handling returns, scheduling tailor appointments, or proactively suggesting a restock of a favorite item before it runs out.

Information Matters research indicates the global B2C retail market could see between $2.1 trillion and $3.2 trillion in orchestrated revenue from agentic commerce by 2030.

B2B Supply Chains: From Reactive to Autonomous. In B2B, Agentic AI acts as a Digital Workforce that bridges the gaps between siloed systems (ERP, CRM, and Logistics).

– Dynamic Sourcing & Procurement: Instead of a human procurement officer manually emailing vendors during a shortage, an Agentic Procurement System can identify a disruption (e.g., a port strike), find alternative suppliers that meet compliance standards, and execute a purchase order in minutes.

– Self-Healing Logistics: Logistics providers (like DHL) are using agents to monitor shipments in real-time. If a delay is detected, the agent doesn’t just “alert” a manager; it evaluates alternative routes, calculates the cost-benefit of air vs. sea, and reroutes the cargo autonomously within pre-set budget parameters.

– Predictive Manufacturing: Multi-agent systems can now “handshake” between the factory floor and the sales team. If a sudden trend is detected on social media, the Demand Agent notifies the Production Agent, which automatically adjusts the manufacturing schedule and orders the necessary raw materials.

Information Matters research suggests that B2B commerce will drive agentic AI adoption over the coming 5 years with between $4.1 trillion and $5.8 trillion in fully orchestrated revenue from agentic commerce by 2030.

Download our report on Agentic EDI

and the $95 billion opportunity