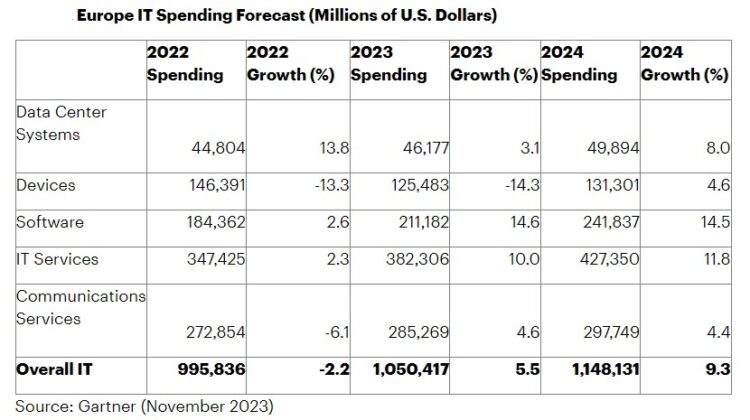

According to a recent forecast by Gartner, Inc., IT spending in Europe is expected to reach $1.1 trillion in 2024, representing a 9.3% increase from 2023. The region is on track to exceed the $1 trillion mark by the end of this year.

John-David Lovelock, Distinguished VP Analyst at Gartner, stated that despite the complex economic situation, IT spending in Europe remains recession-proof. He noted that CIOs in Europe are shifting their focus from a “growth at all costs” strategy to prioritizing cost control, efficiencies, and automation while reducing IT initiatives with longer return on investment (ROI) periods.

Gartner analysts are currently discussing IT spending priorities for IT leaders and CIOs at the Gartner IT Symposium/Xpo, which concludes today. Although artificial intelligence (AI) is a priority for CIOs, it is not yet a primary spending focus. Instead, factors such as revenue generation, profitability, and security are driving IT spending in Europe for the upcoming year.

Software and IT services are the two segments where European CIOs are expected to increase their spending the most in 2024. While there is sufficient investment to maintain existing on-premises data centers, new spending continues to favor cloud options, including infrastructure as a service (IaaS), which is expected to grow by 27% in Europe next year.

CIOs in Europe are also shifting their priorities internally, focusing on enhancing cybersecurity spending in the cloud and planning for AI and generative AI (GenAI). Gartner forecasts that spending on security and risk management in Europe will reach an estimated $56 billion in 2024, a 16% increase from 2023.

The growth in IT services is partly due to talent shortages in European IT departments, leading to a migration of IT skills from enterprise IT departments to technology and service providers (TSPs).

Inflation continues to impact consumer purchasing power, and while businesses and consumers are expected to increase their spending on devices in 2024, the level of IT spending on devices is not estimated to return to 2021 levels until 2027. Austria, Ireland, and Finland are projected to record the biggest bounce back in consumer spending in 2024 among European countries.

The top three most mature countries in Europe – the U.K., Germany, and France – will represent 51% of total IT spending in Europe in 2024, totaling $588 billion, up 9.8% from 2023. Among the international monetary fund (IMF) developing countries, such as Hungary and Poland, IT spending is estimated to total $32.3 billion in 2024, up 9.2% from 2023.

Investment in cloud technology is a key differentiator between mature and developing countries, with the latter facing challenges in cloud adoption due to limited availability of specific cloud applications, platforms, and services, as well as a lack of cloud-specific skills.